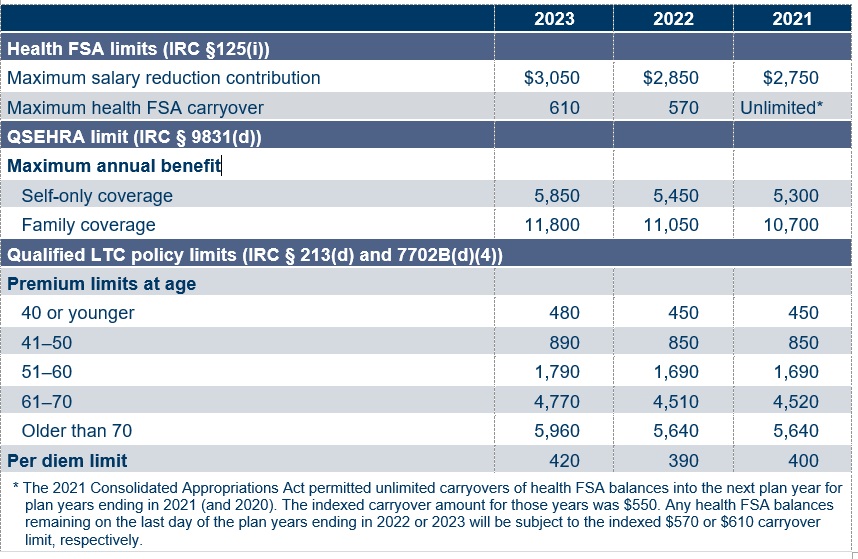

Fsa Employer Contribution Max 2025 Over 65. 2025 2025 healthcare fsa contribution limit. The irs set a maximum fsa contribution limit for 2025 at $3,200 per qualified fsa ($150 more than the prior year).

The irs set a maximum fsa contribution limit for 2025 at $3,200 per qualified fsa ($150 more than the prior year). The irs establishes the maximum fsa contribution limit each year based on inflation.

What Is The Maximum Fsa Contribution For 2025 Tax Year Emylee Winifred, For fsas in 2025, the maximum contribution is $3,050.

Fsa Maximum Contribution 2025 Hermia Roseline, Amounts contributed are not subject to federal income tax, social security tax or medicare tax.

Fsa 2025 Max Contribution Adina Meriel, For 2025, the health fsa contribution limit is $3,200, up from $3,050 in 2025.

IRS Announces 2025 Increases to FSA Contribution Limits SEHP News, The 2025 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2025).

Irs Fsa Contribution Limits 2025 Paige Rosabelle, An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

2025 Fsa Contribution Limits Family Tax Gill, For fsas in 2025, the maximum contribution is $3,050.

2025 Fsa Maximum Contribution Naoma Vernice, In 2025, the fsa contribution limit is $3,200, or roughly $266 a month.

2025 Limited Purpose Fsa Contribution Limits Chart Flor Oriana, In 2025, workers can add an extra $150 to their fsas as the annual contribution limit rises to $3,200 (up from $3,050).

2025 Fsa Contribution Limits Family Members Heath Koressa, An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

2025 Max Fsa Contribution Calla Corenda, Employers can allow employees to carry over $640 from their medical fsa for taxable years beginning in 2025, which is a $30 increase from 2025.